HoReCa market in large cities

Wpis dostępny jest także w języku:

![]() polski

polski

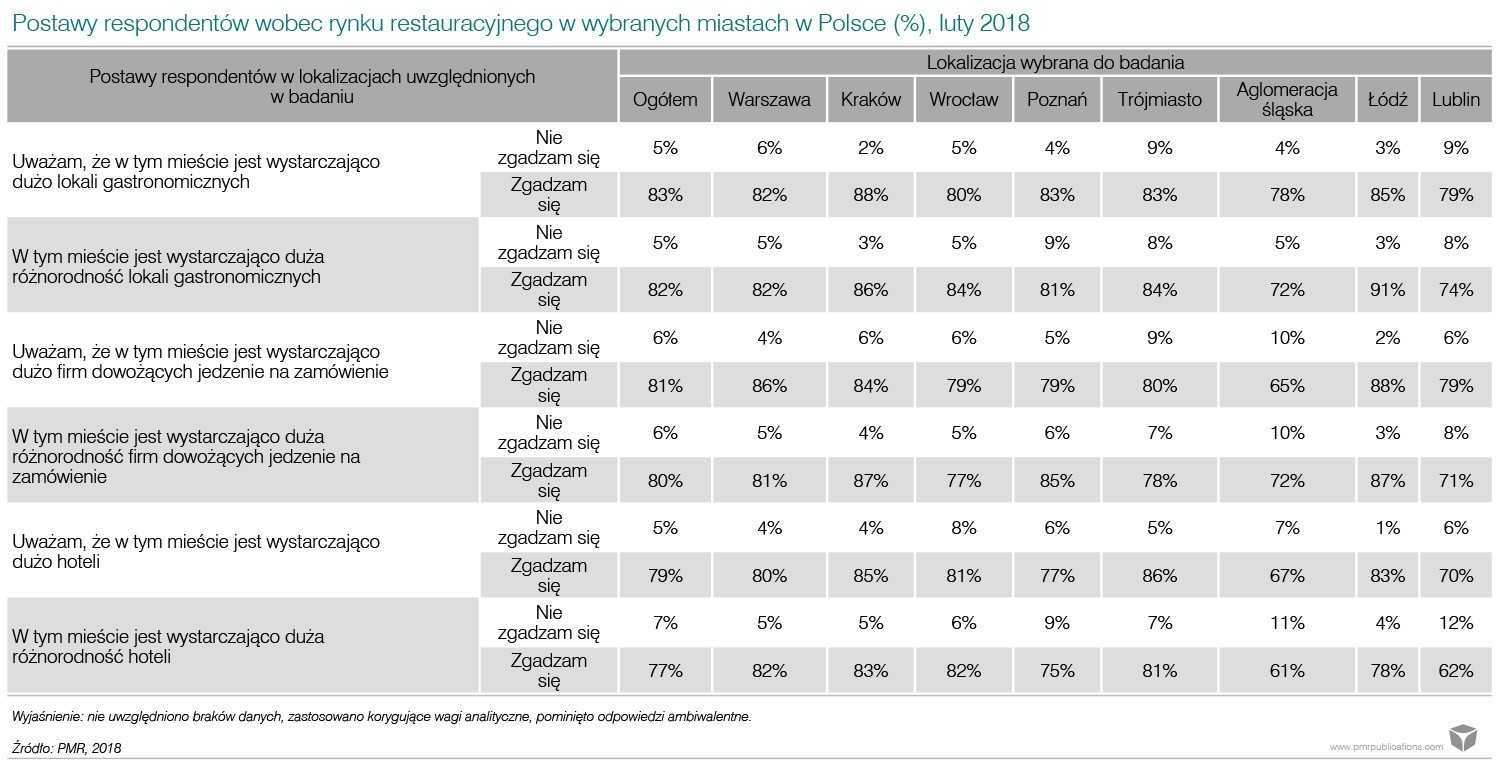

Residents of large Polish cities positively assess both the number and diversity of HoReCa facilities in their cities, although the results for particular locations differ, according to a study conducted in February 2018 by PMR for the purposes of the report “HoReCa market in Poland 2018. Market analysis and development forecasts for 2018-2023”.

The locations included in the study are: Warsaw, Kraków, Wrocław, Poznań, Tricity, Silesian agglomeration (identified as Katowice, Sosnowiec, Gliwice, Zabrze and Bytom), Łódź and Lublin.

In terms of the assessment of catering establishments, more than 80% of all respondents believe that both the number and diversity of such places is sufficient, and only about 5% are of the opposite opinion. A similar assessment is given to hotel facilities, where, according to four fifths of the respondents, both the number and diversity of facilities is sufficient, and only about 5-7% are of the opposite opinion. Also for catering services, the interest rates were similar – 80% and 6% respectively.

The representatives of the Silesian agglomeration, slightly less frequently than the general number of respondents, rate positively the variety of catering establishments, the variety and number of places with delivery as well as the variety and size of the hotel base in their location. A similarly worse perception appears among respondents from Lublin.

On the other hand, respondents living or working in Łódź seem to agree more often that there is a sufficient number and variety of entities in their city that can serve food for transport and are more often more positively disposed towards the variety of catering establishments. Krakow is rated better in terms of diversity and the number of places offering food with delivery. Tricity, on the other hand, is slightly more favourably rated in terms of hotel base (both in terms of its size, as well as in terms of the number of hotels). diversity).

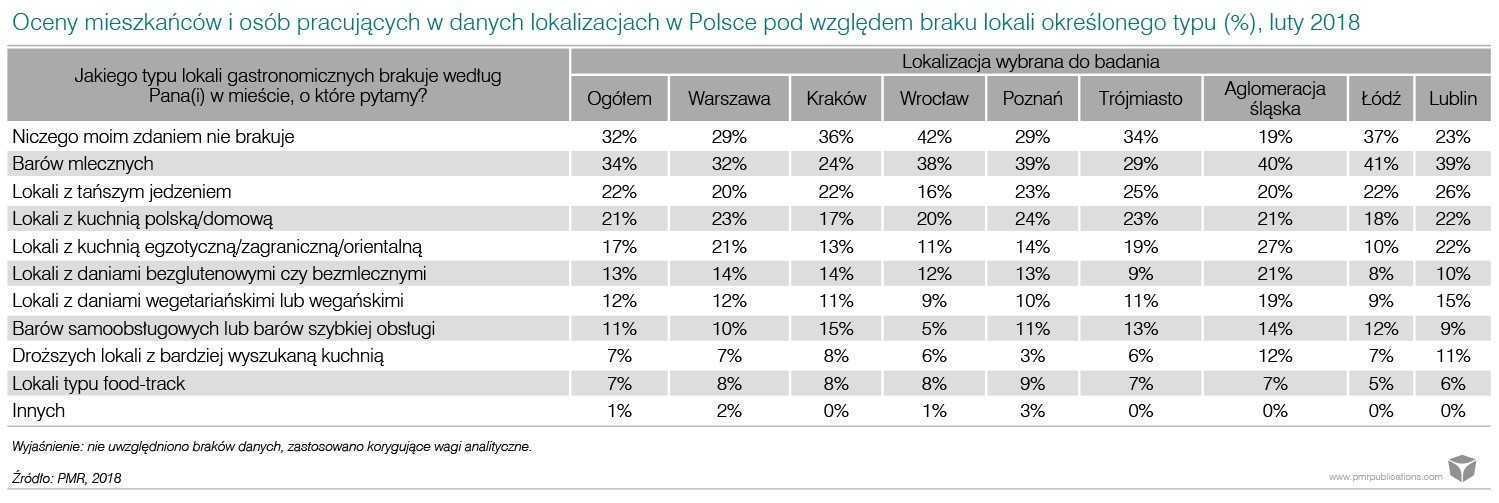

What is the shortage of inhabitants of large cities on the catering market?

The dairy bar is the most frequently indicated type of premises that could potentially be supplemented with catering facilities in the studied locations – it is indicated mainly (34%) by representatives of Łódź and the Silesian agglomeration (but also Poznań or Wrocław). Respondents representing Kraków would definitely less frequently supplement the city’s catering facilities with more milk bars. Apart from milk bars, all respondents more often point to deficiencies in cheaper establishments and establishments with typically Polish food (over 20% of indications). However, 17%, in the context of potentially missing premises, indicate those with a more exotic and oriental offer.

Men more often than women stated that there was a lack of high-end restaurants with a more sophisticated menu. On the other hand, ladies were more often than men convinced that there was a lack of premises with vegetarian cuisine in the cities surveyed. Such a declaration was most often indicated by respondents aged 35-50.

Respondents would complement their cities’ catering facilities with food trays and luxury premises (with more sophisticated cuisine) to the least extent – 7% of indications of a potential addition of catering premises to such locations.

In the Silesian agglomeration, respondents would probably see more oriental/exotic and gluten-free/milk-free or vegetarian/wegian premises more often.