PMR survey: 9 in 10 Poles know Pepco

Wpis dostępny jest także w języku:

![]() polski

polski

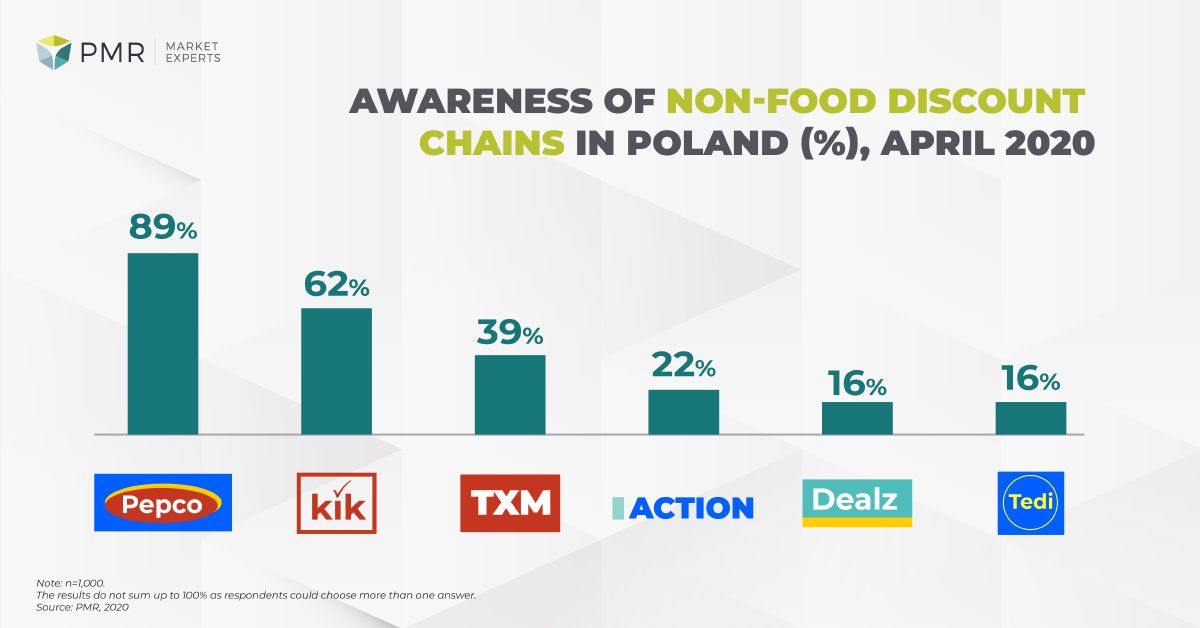

Nearly 90% of people in Poland are familiar with Pepco, almost two thirds know KiK, and just under 40% know TXM, a survey conducted by PMR in April 2020 showed. The three more recent entrants into the country’s non-food discount store sector have also done well to establish themselves in the minds of Polish consumers, with more than a fifth of our respondents saying they know Action, and roughly one in six professing familiarity with Dealz and Tedi.

Another finding of our survey, and a particularly significant one, is that the non-food discounters have large groups of frequent customers. Thus, of the respondents who know Pepco, 93% shop there, and fully 58% visit its stores at least once a month. For KiK, the percentages are 83% and 41%, and for Tedi, 72% and 41%.

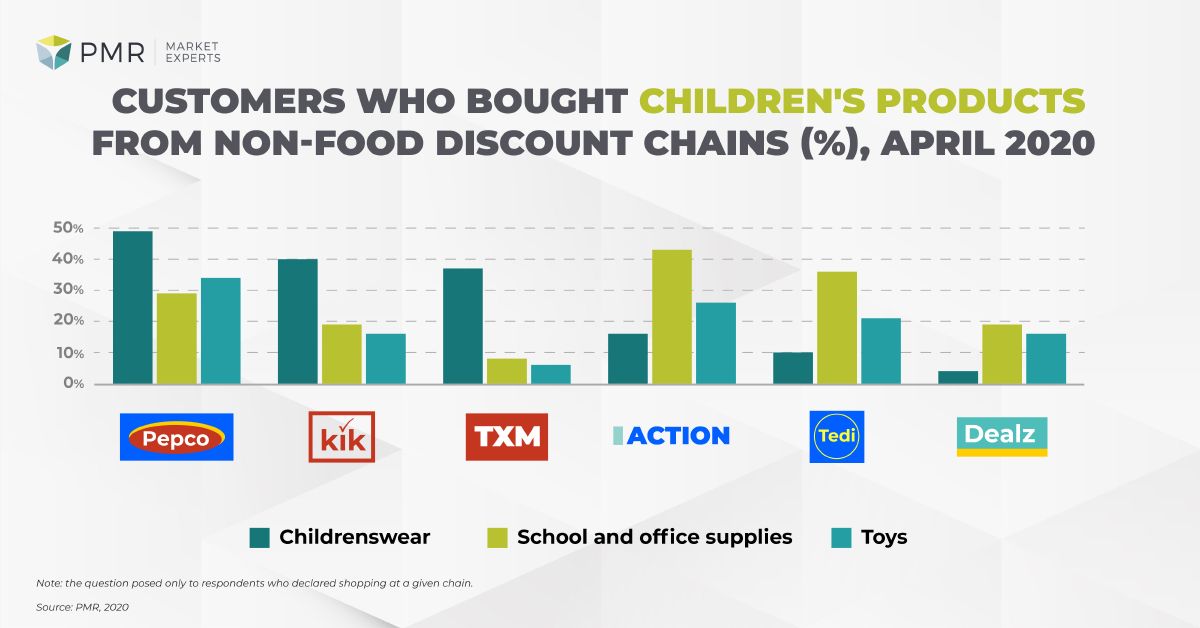

Poles buy children’s products at non-food discounters

Since the non-discount chains market themselves as places to buy things for the home and for the whole family at low prices, all the above chains carry children’s clothing and shoes, and most of them also carry accessories and toys. They are becoming more and more important player in the Polish children’s products market.

Pepco at the lead of non-food discounters

The sector of non-food discount stores in Poland has expanded rapidly over the past decade, with the number of such stores growing by more than 100 annually. In May 2020 there were 1,900 of them in total. The undisputed leader is Pepco, which opened its store number 1,000 in September 2020. In May, when the coronavirus lockdown was lifted, the chain offered 30% off on all products to encourage customers back into its stores and speed up the movement of merchandise – and got an enthusiastic response, with sales surging.

TXM, which is owned by Warsaw Stock Exchange-listed Redan, lost its second place in 2019, as it underwent a deep restructuring that involved many store closures. In Q3 2020 it successfully completed a court-supervised rehabilitation process, however, and began to implement a debt agreement with creditors. A major winner from TXM’s problems is KiK, which has continued to expand fast. It has 348 stores at the moment and plans to open more.

Takko Fashion’s concept is positioned in a somewhat higher price segment compared to rivals, which might partly explain why its expansion has slowed. Tedi, Dealz, and Action illustrate how the segment continues to attract foreign entrants. It also includes more domestic players besides TXM, such as Szachownica, Tifo, or Happy House, which is active in Wielkopolskie.

Featured image from Nieładnie rysuje.

More about purchases for children in the latest PMR report: Children’s products retail market in Poland 2020.

About autor

Magdalena Filip

Senior retail analyst

A senior analyst with ten years of specialization in the retail market in Poland and Central and Eastern Europe. Areas of specializations: clothing and footwear retail market, children’s products market and private labels.