New market leader in consumer electronics market?

Wpis dostępny jest także w języku:

![]() polski

polski

In the coming years, RTV Euro AGD will give way to the market leader for Media Expert. The chain will be the market leader thanks to the opening of new stores and the growing popularity of its online store.

According to PMR estimates, in the coming years Media Expert will overtake the current market leader in consumer electronics. In recent years, the company has recorded double-digit revenue growth, reaching a record 17% growth in 2018. These increases are achieved both by expanding the distribution channel, as well as by increasing the popularity of the chain’s online store. In 2019 alone, the chain opened 18 stores.

According to PMR’s data, internet is the fastest growing channel on consumer electronics market. The channel reaches growth almost twice as fast as the whole market. According to PMR’s forecasts, by 2024 the Internet will reach almost 1/3 of the entire electronic goods market.

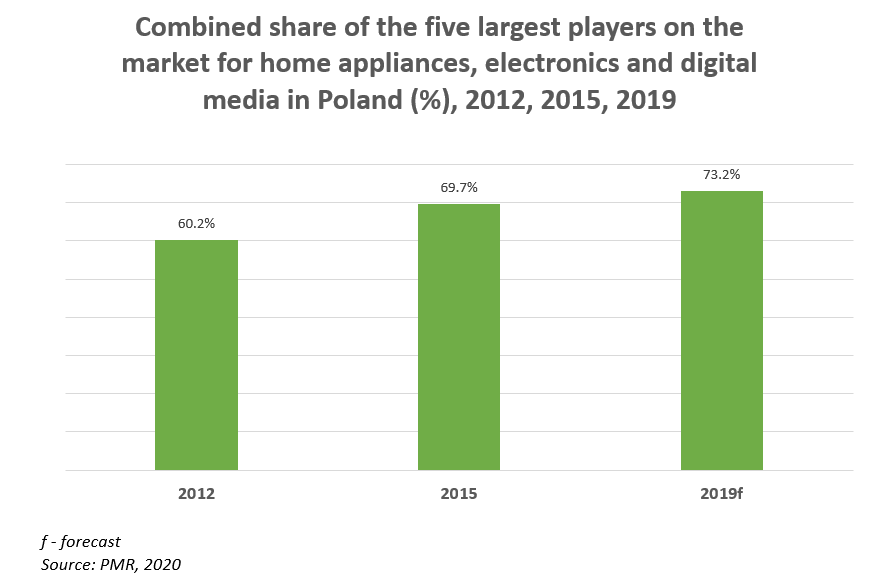

High degree of market concentration

Trade in white and brown goods and electronics is one of the most concentrated parts of the retail market in Poland. The five largest players already have a share of over 70%. The continuing consolidation of the market results from the fact that the large players are growing mainly due to the competitive struggle – i.e., at the expense of rivals – and not thanks to rising demand from consumers. Media Expert’s sales growth is impressive, but some other chains, such as Neonet, are doing worse.

It is also worth noting changes on the market. On the one hand, the position of the largest players, i.e. RTV Euro AGD and Media Expert, is strengthening. On the other hand, the decision by Media Saturn Holding, the number three player, to scrap the Saturn brand and convert the stores to Media Markt shows that even the biggest players have to try harder in order to at least maintain their position.