PMR: Demographic crisis – the main challenge for the children’s products market in Poland in 2021

Wpis dostępny jest także w języku:

![]() polski

polski

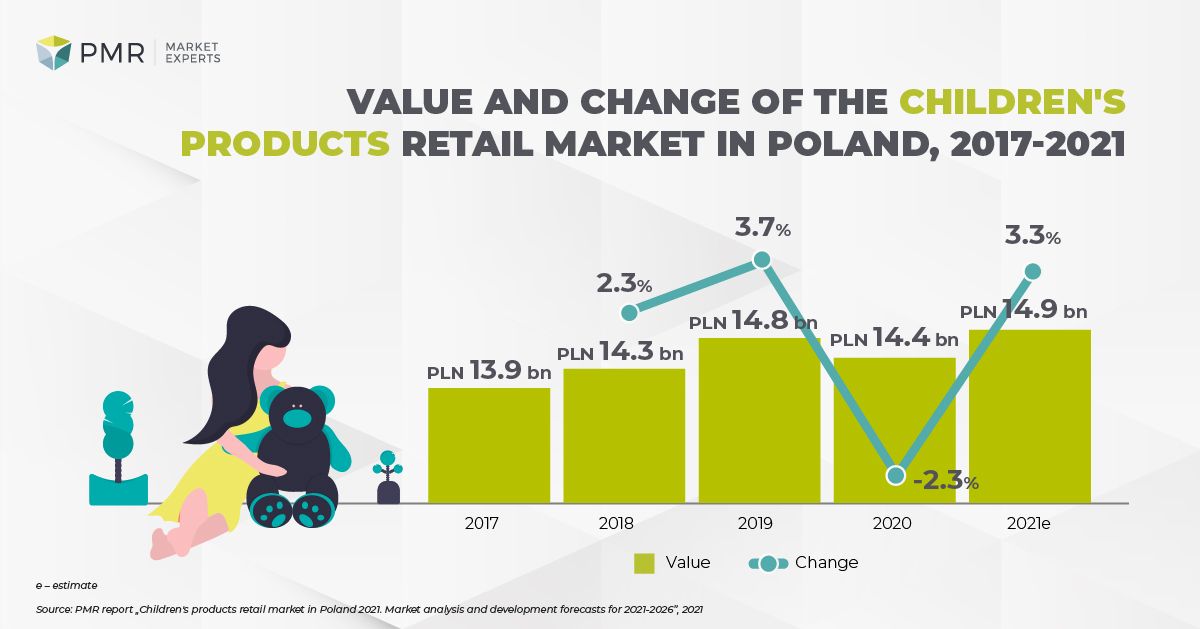

In 2020, the children’s products* market in Poland was worth PLN 14.49bn after a 2.3% y/y decrease, according to the latest PMR report „Children’s products retail market in Poland 2021. Market analysis and development forecasts for 2021-2026”.

More than half (54%) of respondents (i.e. people who buy baby products) of PMR’s September 2021 survey, declare that the COVID-19 outbreak has not affected their purchases of baby products. Purchases in some of the baby product segments we analyzed are non-transferable (e.g., diapers, wet wipes, or food). Sales of some categories were stimulated by the pandemic, including furnishings and toy categories.

The period of lockdown and closed childcare and educational institutions encouraged the re-arrangement of domestic space (separating places for learning/play) as well as the purchase of new games and toys. Particularly popular were those that occupied children for a longer period of time or those that were of interest to parents (following the trend in the kidult toy market).

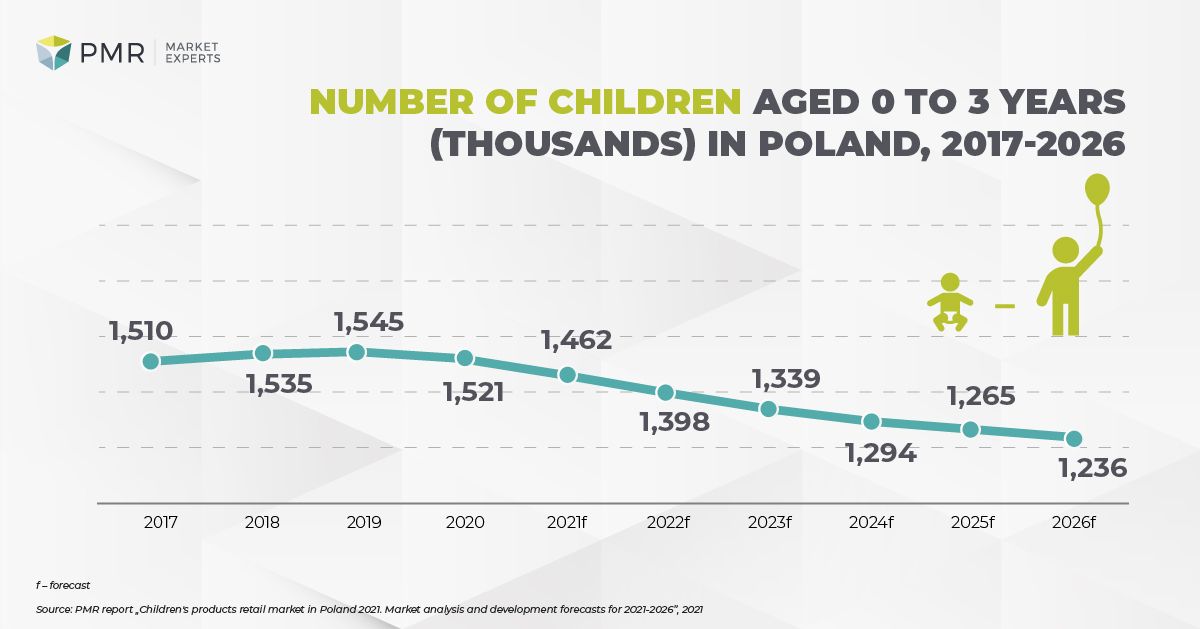

The biggest impediment to the development of the market of products for children in Poland is demography. This trend is very well illustrated by the so-called ageing index. According to the Central Statistical Office (CSO) in Poland it amounts to 121, i.e. there are 121 “grandparents” (persons aged 65 and older) for every 100 “grandchildren” (children aged 0-14) and the difference in the size of these populations is 1.2 million to the disadvantage of children (in cities it reaches 1.3 million, and in rural areas there are still more children – by 99,000).

The very low birth rate in 2020 contributed to a record low rate of natural increase (RNI). More than 355,000 live births were recorded in 2020 (375,000 in 2019). Demographic trends will not reverse over the forecast period. Projections are particularly unfavorable for the number of children in the birth-to-3 age group, which will decline by more than 15% from 2021 to 2026.

Therefore, in the coming years the most difficult situation is expected in segments directly related to demographic forecasts of the number of live births, namely: baby food, where the CAGR forecast by PMR for 2022-2026 is -3.9%, hygiene products, baby carriages and car seats. In the latter categories, secondary trading (re-commerce) remains an additional problem for retailers and manufacturers.

According to a survey conducted by PMR in September 2021 on a purposive sample of adult Poles buying baby products (from any category), of those declaring to have bought a baby carriage within the year preceding the survey, 26% chose a second-hand product (as PMR interviewees operating in this segment happened to emphasise, due to the short usage of e.g. deep baby carriages, those bought in 2020, due to low social mobility last year were relatively little used and further encourage secondary purchase in 2021). For car seats, the corresponding percentage was 28%.

In the other segments of the children’s products market (i.e. children’s clothing, children’s footwear, toys, and children’s furniture and room furnishings), higher household disposable income will more likely cushion negative demographic trends by translating into higher per-child spending.

The migration of shopping to the online channel will continue

Before the outbreak of the pandemic, grocery stores were the largest channel within the baby products market. Their sales – either regular or on the basis of short sales runs – included almost all product segments and categories listed by PMR. However, in 2020, after sales grew by 40.5% y/y, the online channel became the largest channel. Sales through e-stores and shopping platforms accounted for 27.2% of the children’s products market in Poland. At the end of the forecast period – i.e. in 2026. – more than every third PLN (36.6%) spent on the analysed categories will be spent online.

* By children’s products we mean the following articles: clothing (including underwear) and footwear for children, toys, children’s cosmetics and hygiene products (i.e. diapers, wet wipes for child hygiene, hygiene pads, etc.), baby food, children’s furniture and equipment for children’s rooms, baby carriages, car seats and their accessories.

More information in the PMR report: “Children’s products retail market in Poland 2021. Market analysis and development forecasts for 2021-2026“.