PMR: Natural cosmetics market grew over 13% in 2020

Wpis dostępny jest także w języku:

![]() polski

polski

Although the COVID-19 pandemic has partially paralysed stationary trade, it has not harmed the natural cosmetics segment, which grew in 2020 at a rate several times higher than the overall cosmetics market, according to PMR’s latest report “Natural cosmetics market in Poland 2021. Market analysis and development forecasts for 2021-2026”. Moreover, according to PMR forecasts, between 2021 and 2026 the average annual growth rate (CAGR) for the natural cosmetics market will be over 10%.

Positive influences on the market include the growing interest of a large group of consumers in natural care and natural ingredients in cosmetic products, the expanding offer of natural cosmetics in non-specialized stores (especially in grocery discount stores), as well as the expanding product range of natural cosmetics.

We are most likely to buy natural cosmetics during most of our beauty shopping

According to a PMR survey conducted in August 2021 on a representative sample of 1,006 Poles, the highest percentage of Poles (26%) buy natural cosmetics during most of their beauty purchases. These are more likely to be 18-34 year olds and people with incomes of over PLN 5,000 net per capita.

In turn, every 10th respondent includes natural cosmetics in each or almost each cosmetic purchase. This group is also dominated by the 18-34 age group and women.

The largest channel – not only on the cosmetics market in Poland, but also on the natural cosmetics market – are drugstores. According to PMR estimates, this channel accounts for over half of all sales on the natural cosmetics market. According to a survey conducted by PMR, more than half of those who buy natural cosmetics, buy them most often in drugstores.

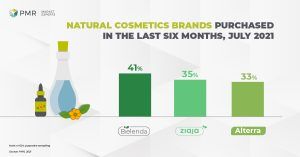

Bielenda – the most popular cosmetics brand

The most popular brand among respondents who bought natural cosmetics in the last six months is Bielenda, purchased by 4 out of 10 respondents. Women, consumers under 35 and residents of cities with population below 20,000 were more inclined to buy cosmetics of this brand.

The next most popular brands are Ziaja and Alterra (Rossmann’s own brand), both more popular among women. Ziaja is also more readily chosen by older consumers over 55.

Among brands produced by celebrities the most popular brand is that of Ewa Chodakowska – BeBio, whose products were bought by every fifth respondent. These were more often women and consumers under 55. The high popularity of the brand is attributed to the affordable price of its products and a relatively wide availability of the brand – the products, among others, are available in Rossmann and Lidl discount stores.

More information in the PMR report : “Natural cosmetics market in Poland 2021. Market analysis and development forecasts for 2021-2026″.

About the author

Karolina Szałas

Retail Market Analyst

Analyst with over four years of experience in retail market. Areas of specialization: clothing and footwear market, cosmetics market and e-commerce.